Insurance Basics

Car insurance is your financial safety net—protecting you from unexpected costs due to accidents, theft, and liability.

Why You Need It

- Legal Requirement: Every state mandates minimum coverage to drive legally.

- Liability Protection: Covers bodily injury and property damage you cause to others.

- Peace of Mind: Mitigates financial risk and ensures you’re not left footing large bills.

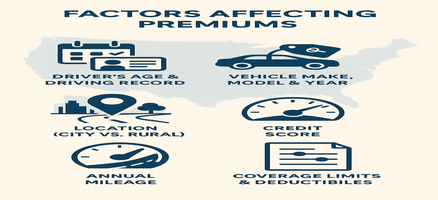

How Premiums Are Calculated

State Minimums

Every state mandates minimum liability coverage. Below is a snapshot of common minimums:

| State | BI | PD | UM/UIM |

|---|---|---|---|

| California | $15k/$30k | $5k | Optional |

| Texas | $30k/$60k | $25k | $30k/$60k |

| Florida | $10k/$20k | $10k | Optional |

| State | BI | PD | UM/UIM |

|---|---|---|---|

| Alabama | $25k/$50k | $25k | $25k/$50k |

| Alaska | $50k/$100k | $25k | Not Required |

| Arizona | $25k/$50k | $15k | Not Required |

| Arkansas | $25k/$50k | $25k | $25k/$50k |

| Colorado | $25k/$50k | $15k | Not Required |

| Connecticut | $25k/$50k | $25k | $25k/$50k |

| Delaware | $25k/$50k | $10k | Not Required |

| Georgia | $25k/$50k | $25k | $25k/$25k |

| Hawaii | $20k/$40k | $10k | Not Required |

| Idaho | $25k/$50k | $15k | Not Required |

| Illinois | $25k/$50k | $20k | Not Required |

| Indiana | $25k/$50k | $25k | $25k/$50k |

| Iowa | $20k/$40k | $15k | Not Required |

| Kansas | $25k/$50k | $25k | Not Required |

| Kentucky | $25k/$50k | $10k | $25k/$50k |

| Louisiana | $15k/$30k | $25k | $15k/$30k |

| Maine | $50k/$100k | $25k | Not Required |

| Maryland | $30k/$60k | $15k | $30k/$60k |

| Massachusetts | $20k/$40k | $5k | Not Required |

| Michigan | Unlimited PIP | $10k | Not Required |

| Minnesota | $30k/$60k | $10k | Not Required |

| Mississippi | $25k/$50k | $25k | Not Required |

| Missouri | $25k/$50k | $25k | Not Required |

| Montana | $25k/$50k | $20k | Not Required |

| Nebraska | $25k/$50k | $25k | Not Required |

| Nevada | $25k/$50k | $20k | Not Required |

| New Hampshire | Not Required | Not Required | $25k/$50k |

| New Jersey | $15k/$30k | $5k | $15k/$30k |

| New Mexico | $25k/$50k | $10k | Not Required |

| New York | $25k/$50k | $10k | Not Required |

| North Carolina | $30k/$60k | $25k | Not Required |

| North Dakota | $25k/$50k | $25k | Not Required |

| Ohio | $25k/$50k | $25k | Not Required |

| Oklahoma | $25k/$50k | $25k | Not Required |

| Oregon | $25k/$50k | $20k | Not Required |

| Pennsylvania | $15k/$30k | $5k | Optional |

| Rhode Island | $25k/$50k | $25k | Optional |

| South Carolina | $25k/$50k | $25k | $25k/$50k |

| South Dakota | $25k/$50k | $25k | Not Required |

| Tennessee | $25k/$50k | $15k | Not Required |

| Utah | $25k/$65k | $15k | Not Required |

| Vermont | $25k/$50k | $10k | Optional |

| Virginia | $25k/$50k | $20k | Not Required |

| Washington | $25k/$50k | $10k | Not Required |

| West Virginia | $25k/$50k | $25k | Not Required |

| Wisconsin | $25k/$50k | $10k | Not Required |

| Wyoming | $25k/$50k | $20k | Not Required |

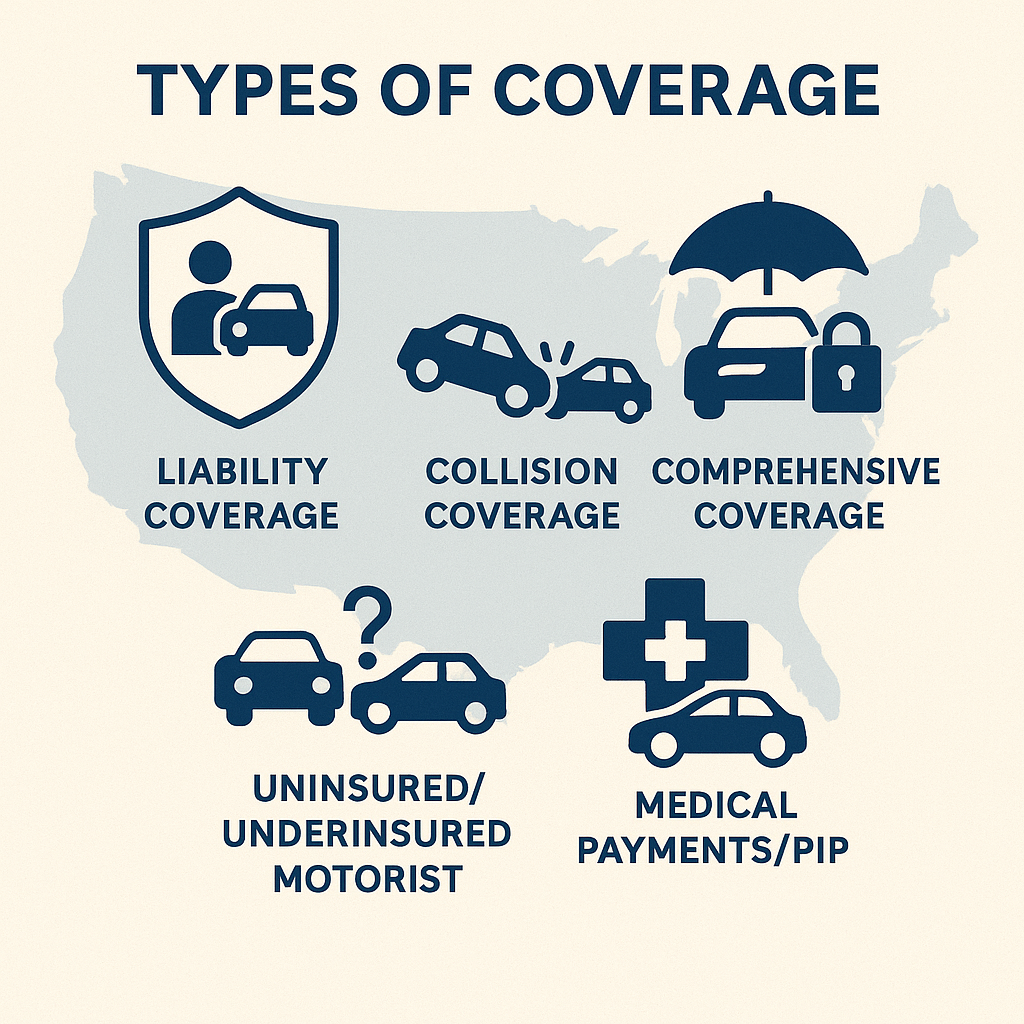

Coverage Options

Liability Coverage

What it is: Mandatory in most states, this pays for bodily injury and property damage you cause to others.

Why it matters: Average liability claim is $15,000; insufficient limits can expose you to personal lawsuits.

Collision Coverage

What it is: Covers repair costs for your vehicle after a collision, regardless of fault.

Why it matters: Collision repairs average $3,500; essential for newer vehicles or financed cars.

Comprehensive Coverage

What it is: Protects against non-collision events: theft, vandalism, fire, and natural disasters.

Why it matters: Comprehensive claims average $2,200 and cover risks collision won’t.

Uninsured/Underinsured Motorist

What it is: Covers medical expenses and damages if hit by a driver without sufficient insurance.

Why it matters: 12% of drivers uninsured; UM/UIM protects your finances against them.

Medical Payments (PIP)

What it is: Pays medical and funeral costs for you and your passengers, regardless of fault.

Why it matters: Covers up to policy limits—useful where health coverage is limited.

Roadside Assistance

What it is: Provides towing, jump-starts, tire changes, and lockout services.

Why it matters: 1 in 4 drivers experiences a breakdown annually; saves time and expense.

Glossary

Premium

Definition: Your periodic payment to keep coverage active.

Impact: Higher risk profiles can raise premiums by 30%+

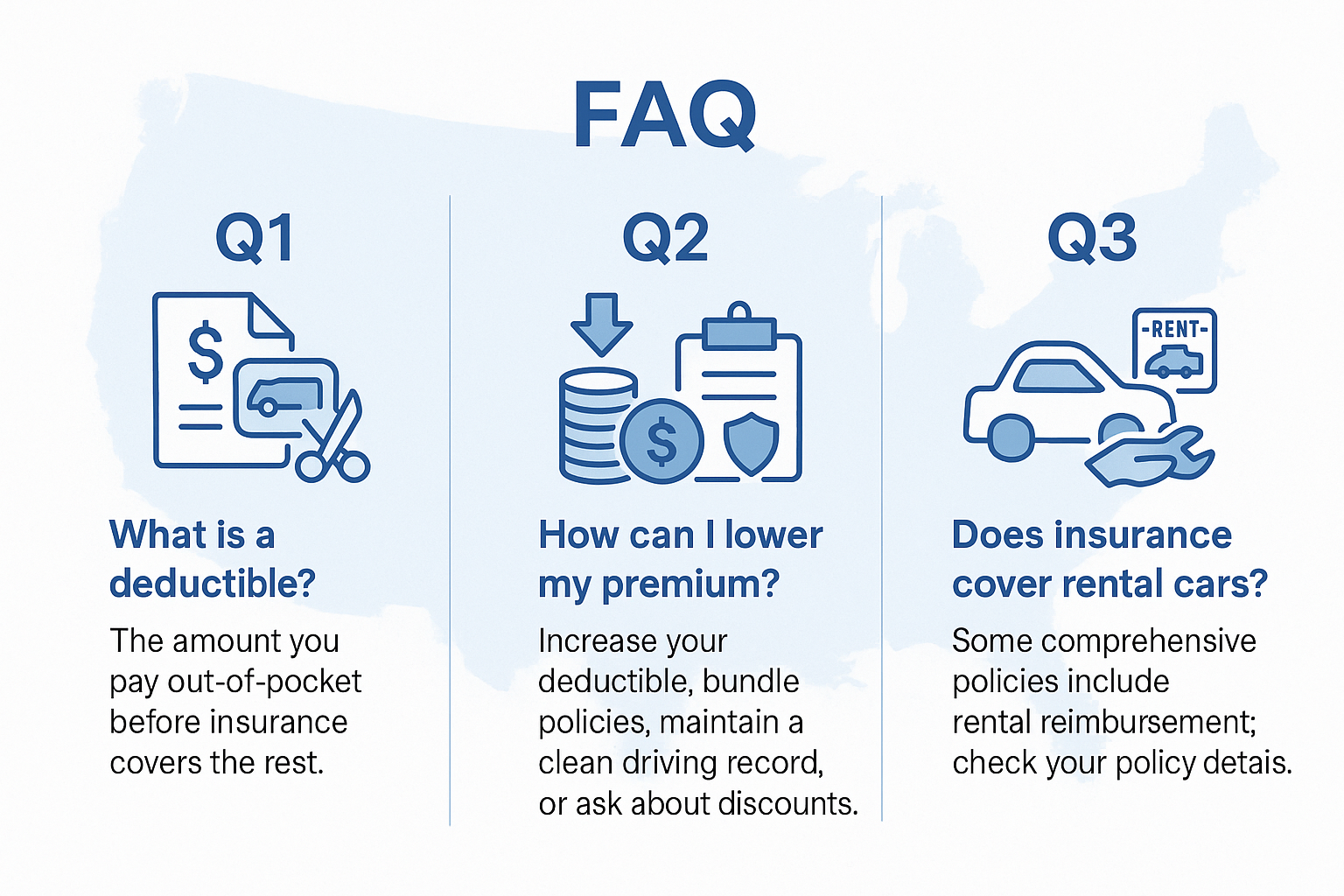

Deductible

Definition: Out-of-pocket amount before coverage starts.

Tip: Opt for higher deductibles to lower your premium up to 20%.

Policy Limit

Definition: Maximum payout per incident.

Note: Consider 100/300 over state minimum to protect your assets.

Claim

Definition: A request for covered loss reimbursement.

Pro Tip: Avoid small claims to prevent rate hikes.

Exclusion

Definition: Situations not covered by your policy.

Advice: Review exclusions on your declarations page.

Underwriting

Definition: Insurer’s risk assessment process.

How it affects you: Clean record leads to preferred rates.

Pros & Cons of Coverages

Collision Coverage

- Pros: Repairs regardless of fault; peace of mind.

- Cons: Higher premiums; not cost-effective for older cars.

Comprehensive Coverage

- Pros: Covers non-collision risks like theft, hail, and fire.

- Cons: Adds premium cost; may not pay off for low-value vehicles.

Uninsured/Underinsured Motorist

- Pros: Financial protection against uninsured drivers.

- Cons: Extra cost; may duplicate medical coverage.

Medical Payments (PIP)

- Pros: No-fault medical coverage for passengers.

- Cons: Limited limits; overlaps with health insurance.

Types of Insurance Policies

- Named Driver Policy: Only covers listed drivers; lowers premium but restrictive.

- Open Driver Policy: Covers any licensed driver; higher premium, more flexibility.

- Usage-Based Insurance (UBI): Telematics-based; pay-as-you-drive rates.

- Pay-Per-Mile Insurance: Low base rate plus per-mile charge; ideal for low-mileage drivers.

- Classic Car Insurance: Specialized valuation for antiques; usage restrictions apply.

Pre-Purchase Checklist

Determine Vehicle Value

Use Kelley Blue Book or NADA to assess current market value.

Check Available Discounts

Bundle policies, safe driver, low-mileage, and good-student options.

Compare Multiple Quotes

Use our platform to view at least 3-5 carrier quotes side by side.